Section: Chapter Questions Problem 9P See similar textbooks Related questions Question A5 Transcribed Image Text: Kathy is 60 years of age and self-employed. During 2023 she reported $106,000 of revenues and $41,200 of expenses relating to her self-employment activities.

Kathy Bleier Coaching

May 23, 2022Kathy is 60 years of age and self-employed. During 2018, she reported $112,000 of revenues and $42,400 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a simplified employee pension (SEP) IRA for 2018?

Source Image: bu.edu

Download Image

Question Answered step-by-step Asked by SargentGoatMaster963 on coursehero.com Kathy is 60 years of age and self-employed. During 2020 she… Kathy is 60 years of age and self-employed. During 2020 she reported $109,000 of revenues and $41,800 of expenses relating to her self-employment activities.

Source Image: msnbc.com

Download Image

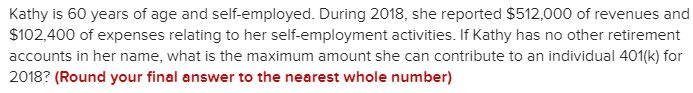

serving our community for 60 years – Oakville Hospital Foundation Kathy is 60 years of age and self-employed. During 2023, she reported $500,000 of revenues and $100,000 of expenses relating to her self-employment activities.If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401 (k) for 2023 ?

Source Image: hrw.org

Download Image

Kathy Is 60 Years Of Age And Self Employed

Kathy is 60 years of age and self-employed. During 2023, she reported $500,000 of revenues and $100,000 of expenses relating to her self-employment activities.If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401 (k) for 2023 ? A. $381,867. B. $80,000. C. $61,000. D. $55,000. 2. Kathy is 60 years of age and self-employed. During 2018, she reported $516,000 of revenues and $103,200 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401 (k) for 2018

At Least Let Them Work”: The Denial of Work Authorization and Assistance for Asylum Seekers in the United States | HRW

Section: Chapter Questions Problem 22CE See similar textbooks Related questions Question 100% Transcribed Image Text: Kathy is 60 years of age and self-employed. During 2023, she reported $522,000 of revenues and $104, 400 of expenses relating to her self-employment activities. Solved Kathy is 60 years of age and self-employed. During | Chegg.com

Source Image: chegg.com

Download Image

For Billie Jean King, the battle never ends| Adobe Blog Section: Chapter Questions Problem 22CE See similar textbooks Related questions Question 100% Transcribed Image Text: Kathy is 60 years of age and self-employed. During 2023, she reported $522,000 of revenues and $104, 400 of expenses relating to her self-employment activities.

Source Image: blog.adobe.com

Download Image

Kathy Bleier Coaching Section: Chapter Questions Problem 9P See similar textbooks Related questions Question A5 Transcribed Image Text: Kathy is 60 years of age and self-employed. During 2023 she reported $106,000 of revenues and $41,200 of expenses relating to her self-employment activities.

Source Image: m.facebook.com

Download Image

serving our community for 60 years – Oakville Hospital Foundation Question Answered step-by-step Asked by SargentGoatMaster963 on coursehero.com Kathy is 60 years of age and self-employed. During 2020 she… Kathy is 60 years of age and self-employed. During 2020 she reported $109,000 of revenues and $41,800 of expenses relating to her self-employment activities.

Source Image: yumpu.com

Download Image

PEANUTS Customized Leather Credit Card Holder|Saffiano Blue|Crudo Leather Craft Oct 3, 2023VIDEO ANSWER: Hello everyone, the question says that k t is 60 years of age and self employed, she reported 100000 dollars of revenues and 40000 dollars of expenses relating to her self employment activities. What is the maximum amount of cathy’s

Source Image: crudo-leather.com

Download Image

Celebrity Chef Kathy Fang On What It Takes to Create a Highly Successful Career as a Restaurateur | by Maria Angelova, CEO of Rebellious Intl. | Authority Magazine | Medium Kathy is 60 years of age and self-employed. During 2023, she reported $500,000 of revenues and $100,000 of expenses relating to her self-employment activities.If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401 (k) for 2023 ?

Source Image: medium.com

Download Image

TaxAct 2024 (Tax Year 2023) Review | PCMag A. $381,867. B. $80,000. C. $61,000. D. $55,000. 2. Kathy is 60 years of age and self-employed. During 2018, she reported $516,000 of revenues and $103,200 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401 (k) for 2018

Source Image: pcmag.com

Download Image

For Billie Jean King, the battle never ends| Adobe Blog

TaxAct 2024 (Tax Year 2023) Review | PCMag May 23, 2022Kathy is 60 years of age and self-employed. During 2018, she reported $112,000 of revenues and $42,400 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a simplified employee pension (SEP) IRA for 2018?

serving our community for 60 years – Oakville Hospital Foundation Celebrity Chef Kathy Fang On What It Takes to Create a Highly Successful Career as a Restaurateur | by Maria Angelova, CEO of Rebellious Intl. | Authority Magazine | Medium Oct 3, 2023VIDEO ANSWER: Hello everyone, the question says that k t is 60 years of age and self employed, she reported 100000 dollars of revenues and 40000 dollars of expenses relating to her self employment activities. What is the maximum amount of cathy’s