Finally, impose a progressive tax such that the tax rate is 0 0 0 percent when GDP is 100 100 100 dollars, 5 5 5 percent at 200 200 200 dollars, 10 10 10 percent at 300 300 300 dollars, 15 15 15 percent at 400 400 400 dollars, and so forth. Determine and graph the new consumption schedule, noting the effect of this tax system on the MPC and the

Understanding Marginal Tax Rates – FasterCapital

Economics Economics questions and answers Refer to the following table for Waxwania: Instructions: Enter your answers as a whole number. a. What is the marginal tax rate in Waxwania? percent b. What is the average tax rate? percent c. Which of the following describes the tax system: proportional, progressive, or regressive?

Source Image: fastercapital.com

Download Image

What is the marginal tax rate in Waxwania? ____percent —The average tax rate? _____percent b. Suppose Waxwania is producing $600 of real GDP, whereas the potential real GDP (or full-employment real GDP) is $700. -How large is its budget deficit? $____ -Its cyclically adjusted budget deficit? $____

Source Image: m.youtube.com

Download Image

PPT – Marginal Tax Rate (MTR) PowerPoint Presentation, free download – ID:4266129 Refer to the following table for Waxwania: Government Expenditures, G Tax Revenues, T Real GDP $170 $100 $500 170 120 600 170 140 700 170 160 800 170 180 900 Instructions: Enter your answers as a whole number. a. What is the marginal tax rate in Waxwania? percent b. What is the average tax rate? percent c.

Source Image: oecd-ilibrary.org

Download Image

A What Is The Marginal Tax Rate In Waxwania

Refer to the following table for Waxwania: Government Expenditures, G Tax Revenues, T Real GDP $170 $100 $500 170 120 600 170 140 700 170 160 800 170 180 900 Instructions: Enter your answers as a whole number. a. What is the marginal tax rate in Waxwania? percent b. What is the average tax rate? percent c. Refer to the following table for Waxwania: What is the marginal tax rate in Waxwania? The average tax rate? Which of the following describes the tax system: proportional, progressive, regressive?

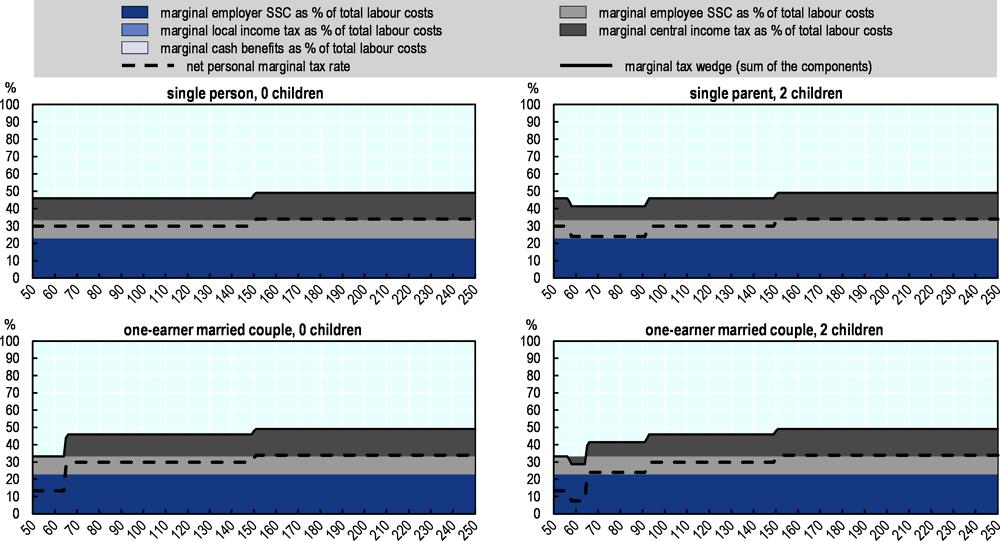

4. Graphical exposition of effective tax rates in 2022 | Taxing Wages 2023 : Indexation of Labour Taxation and Benefits in OECD Countries | OECD iLibrary

What is the marginal tax rate in Waxwania? The average tax r | Quizlet Related questions with answers a. Graph this consumption schedule. WTiat is the size of the MPC? 10 billion dollars is imposed at all levels of GDP. Calculate the tax rate at each level of GDP. The effect of marginal tax rates on income: a panel study of ‘bracket creep’ – ScienceDirect

Source Image: sciencedirect.com

Download Image

What are Marginal Tax Rates? – WFFA CPAs What is the marginal tax rate in Waxwania? The average tax r | Quizlet Related questions with answers a. Graph this consumption schedule. WTiat is the size of the MPC? 10 billion dollars is imposed at all levels of GDP. Calculate the tax rate at each level of GDP.

Source Image: wffacpa.com

Download Image

Understanding Marginal Tax Rates – FasterCapital Finally, impose a progressive tax such that the tax rate is 0 0 0 percent when GDP is 100 100 100 dollars, 5 5 5 percent at 200 200 200 dollars, 10 10 10 percent at 300 300 300 dollars, 15 15 15 percent at 400 400 400 dollars, and so forth. Determine and graph the new consumption schedule, noting the effect of this tax system on the MPC and the

Source Image: fastercapital.com

Download Image

PPT – Marginal Tax Rate (MTR) PowerPoint Presentation, free download – ID:4266129 What is the marginal tax rate in Waxwania? ____percent —The average tax rate? _____percent b. Suppose Waxwania is producing $600 of real GDP, whereas the potential real GDP (or full-employment real GDP) is $700. -How large is its budget deficit? $____ -Its cyclically adjusted budget deficit? $____

Source Image: slideserve.com

Download Image

Understanding the marginal tax rate – YouTube Nov 13, 2023To get their marginal tax rate, take the percentage from the progressive scale from dollars earned within each bracket. For our example earner, that equates to: Tax rate. Taxable income. Taxes owed per bracket (bracket’s taxable income × bracket’s tax rate) 10%. $0 to $11,000. $1,100 ($11,000 × 0.10) 12%.

Source Image: youtube.com

Download Image

Marginal Tax Rate: Unraveling the Marginal Tax Rate’s Effect on NOPAT – FasterCapital Refer to the following table for Waxwania: Government Expenditures, G Tax Revenues, T Real GDP $170 $100 $500 170 120 600 170 140 700 170 160 800 170 180 900 Instructions: Enter your answers as a whole number. a. What is the marginal tax rate in Waxwania? percent b. What is the average tax rate? percent c.

Source Image: fastercapital.com

Download Image

Tax Computation: Tax Marginal Tax Rate Versus Average Tax Rate – YouTube Refer to the following table for Waxwania: What is the marginal tax rate in Waxwania? The average tax rate? Which of the following describes the tax system: proportional, progressive, regressive?

Source Image: m.youtube.com

Download Image

What are Marginal Tax Rates? – WFFA CPAs

Tax Computation: Tax Marginal Tax Rate Versus Average Tax Rate – YouTube Economics Economics questions and answers Refer to the following table for Waxwania: Instructions: Enter your answers as a whole number. a. What is the marginal tax rate in Waxwania? percent b. What is the average tax rate? percent c. Which of the following describes the tax system: proportional, progressive, or regressive?

PPT – Marginal Tax Rate (MTR) PowerPoint Presentation, free download – ID:4266129 Marginal Tax Rate: Unraveling the Marginal Tax Rate’s Effect on NOPAT – FasterCapital Nov 13, 2023To get their marginal tax rate, take the percentage from the progressive scale from dollars earned within each bracket. For our example earner, that equates to: Tax rate. Taxable income. Taxes owed per bracket (bracket’s taxable income × bracket’s tax rate) 10%. $0 to $11,000. $1,100 ($11,000 × 0.10) 12%.